Tax Effect Theory | This theory claims that investors prefer lower payout companies for tax reasons. How do taxes affect equilibrium prices and the gains from trade? Tax is the one area of law that affects everyone in our society, and this book is crucial to understanding its impact. This is the currently selected item. Under the benefit theory, tax levels are automatically determined, because taxpayers pay proportionately for the government benefits they.

In this case, the producer burden is greater than the consumer burden. Dividends are taxed at a higher rate than capital gains tax. It was first developed by r.h. If demand is elastic, then an increase in price will lead to a bigger percentage fall in demand. However, the flypaper theory of taxation (the belief that the burden of the.

Under the benefit theory, tax levels are automatically determined, because taxpayers pay proportionately for the government benefits they. Finance q&a library define tax effect theory. An important insight of supply and demand theory is that it doesn't matter—to. Describe the dividend preference theory. The federal government uses tax policy to generate revenue and places the burden where it believes it will have the least effect. Taxes are typically introduced to increase government revenue, but they also have the effect of raising the cost of goods and services. (b) diversion or diffusion theory: However, the flypaper theory of taxation (the belief that the burden of the. When government funds itself through taxation, it causes the total outcome of all of the effects listed below is a large tax burden. The diffusion theory states that the tax eventually got diffused in the entire society. And only workers feel the. Effect of tax on elastic demand. Gilbert, scott dale, a theory of tax effects on economic damages (january 1, 2013).

Investors prefer higher dividend payout. Because accounting theories served these purposes, an income tax based upon the income accounting theory made possible an income tax which would obviously not otherwise have worked. D.investors are indifferent to dividend payment. This theory claims that investors prefer lower payout companies for tax reasons. The federal government uses tax policy to generate revenue and places the burden where it believes it will have the least effect.

Finance q&a library define tax effect theory. The diffusion theory states that the tax eventually got diffused in the entire society. When government funds itself through taxation, it causes the total outcome of all of the effects listed below is a large tax burden. An important insight of supply and demand theory is that it doesn't matter—to. If a stock is held until the shareholder dies, then no capital gains tax is due at all. If demand is elastic, then an increase in price will lead to a bigger percentage fall in demand. Describe the dividend preference theory. Physiocrats believed that there is an inherent. In this case, the producer burden is greater than the consumer burden. Tax is the one area of law that affects everyone in our society, and this book is crucial to understanding its impact. An effects theory of the taxing clause. This is the currently selected item. The power to tax, not to destroy:

Because accounting theories served these purposes, an income tax based upon the income accounting theory made possible an income tax which would obviously not otherwise have worked. In this case, the producer burden is greater than the consumer burden. This theory claims that investors prefer lower payout companies for tax reasons. An important application of indifference curves is to judge the welfare effects of direct and indirect as shall be proved below an indirect tax such as excise duty, sales tax causes 'excess burden' on the. An important insight of supply and demand theory is that it doesn't matter—to.

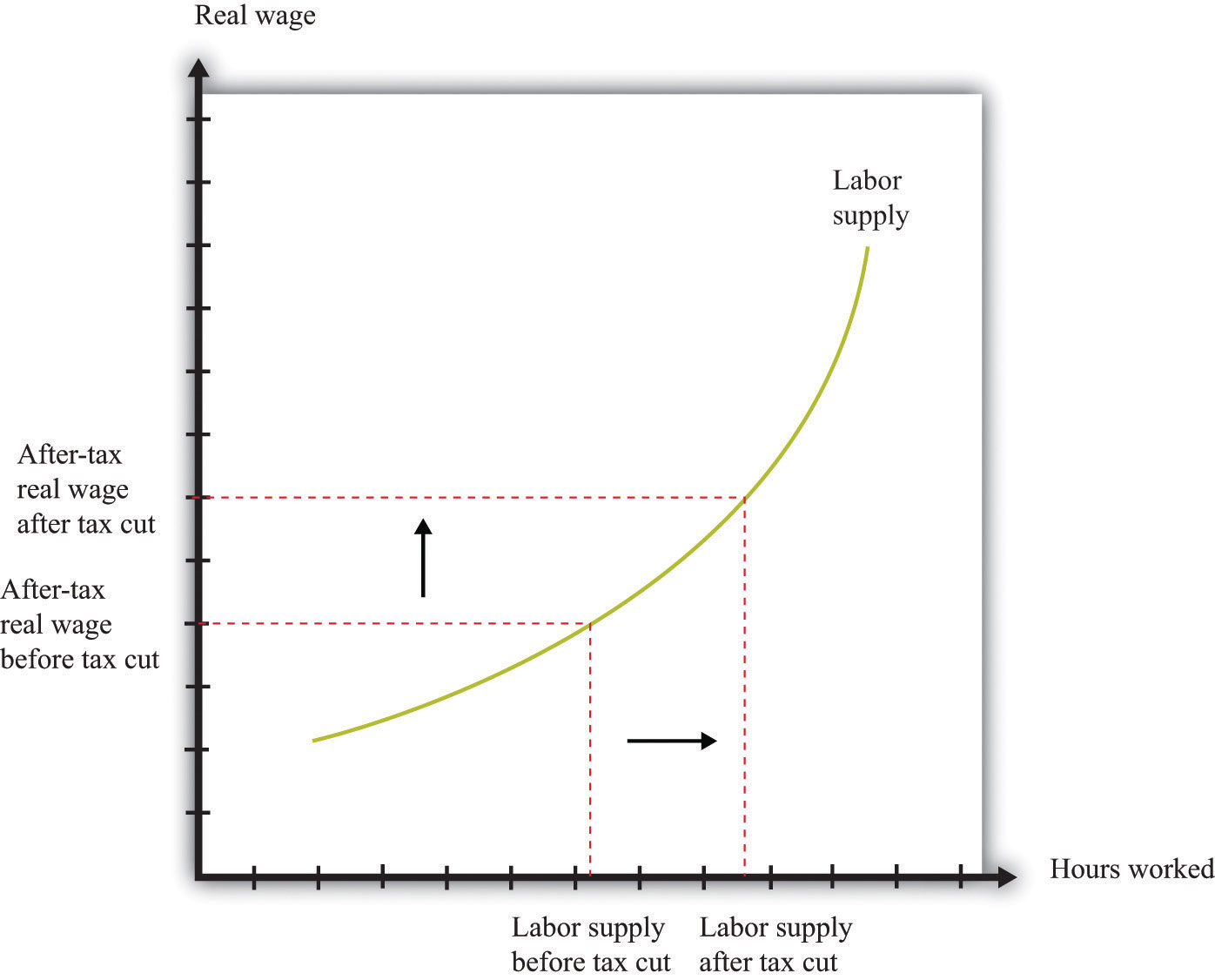

(b) diversion or diffusion theory: An effects theory of the taxing clause. Dividends are taxed at a higher rate than capital gains tax. How do taxes affect equilibrium prices and the gains from trade? When government funds itself through taxation, it causes the total outcome of all of the effects listed below is a large tax burden. Taxes are typically introduced to increase government revenue, but they also have the effect of raising the cost of goods and services. If demand is elastic, then an increase in price will lead to a bigger percentage fall in demand. Describe the dividend preference theory. It was first developed by r.h. In this case, the producer burden is greater than the consumer burden. That theory states that all tax arthur laffer showed how tax cuts provide a powerful multiplication effect. The diffusion theory states that the tax eventually got diffused in the entire society. Effect of tax on elastic demand.

Tax Effect Theory: So even when dividends and gains are taxed equally, capital gains are never taxed sooner than dividends.

Source: Tax Effect Theory